Written by:

Will Chandler

SVP of Operations

Kinetic Advantage

View Will’s Bio

One of the key challenges that independent auto dealers face is managing their cash flow, which can be especially difficult when you are dealing with high-value assets like cars.

This is where flooring lines of credit come in, providing dealers with the financing they need to keep their inventory stocked and their business thriving.

Dealership floor plan loans are specialized solutions distinct from traditional financing methods. As the primary form of inventory financing, floor plans enable dealers to purchase vehicle inventory based on immediate requirements.

Continue reading to learn more about how flooring lines of credit work.

An Essential Tool for Independent Dealers

Floor planning is quite indispensable for the independent automotive sector as it allows for escalating sales volume by facilitating inventory expansion, particularly during peak sale periods.

Specialty lenders, often called floor plan finance companies (like Kinetic Advantage), extend this credit line to auto dealers, allowing them to buy vehicle inventory.

The dealership repays the loan once the inventory is sold to customers or the loan matures.

In certain situations, inventory may not sell within the expected period. In such cases, depending on the terms of the agreement, dealerships may incur additional fees. This necessitates effective inventory management to prevent unsold inventory and unnecessary costs.

Note: Before working with a floorplan company, I would recommend that you specifically ask how they work with you to improve turn times and what technology they provide to help you manage your inventory effectively.

See how Kinetic helps improve turn times here

Learn more about Kinetic’s inventory management software here

Initial Investment and Benefits of Floor Plan Loans

The initial investment for purchasing a vehicle through floor plan financing is typically a small fraction of the vehicle’s actual purchase price. When a dealership sells these vehicles, it allows them to realize immediate profits and repay the loan’s principal value.

Different floor plan loan companies have different fees so this is an important aspect to cover before agreeing to the terms of any floor plan loan.

If you have utilized a floor plan line of credit before and you are frustrated by the fees, take a deeper look at Kinetic’s floor plan which allows you to maintain your cash flow without those excessive and unexpected fees.

Floor plan financing offers a significant level of flexibility for used car dealerships. They can efficiently manage their funds and choose to invest in fine-tuning their business operations. It’s seen as an investment where success reaps substantial rewards.

Get Floorplanning News & Insights Straight to Your Inbox

The dealership floorplanning newsletter that takes a look into recent floorplan news & trends, as well as updates from inside the walls at Kinetic Advantage.

The low upfront cost is a significant advantage of floor plan lines of credit, allowing dealerships to retain a larger portion of their working capital for other aspects of their operations. Thus, it eases the financial pressure and ensures smoother day-to-day business operations.

Moreover, the flexible nature of floor plan financing enables dealers to increase or decrease their line of credit based on their inventory needs and market trends. This allows for enhanced cash flow management.

In other words, the benefits of this financing model extend beyond simple inventory acquisition, providing dealers with a robust tool to manage cash flow and optimize financial performance.

Harnessing the Power of Floor Plan Lines of Credit: Scope and Limitations

Exclusive Benefits for Auto Dealers

Floor plan finance companies offer solutions tailored to the unique needs of auto dealers. Understanding the industry position of these independent dealerships, they provide financing options that mirror their capital requirements and selling cycles. They also offer excellent benefits that are not typically found in traditional financing methods.

One such benefit is the freedom to keep funds actively invested in the dealership, enhancing their overall financial liquidity. On top of that, there are provisions to extend payment dates and increase credit lines. This flexibility further empowers dealerships, aiding them in effectively handling their finance-related decisions.

Grow Your Business With Kinetic Advantage

Grow Your Business With Kinetic Advantage

210 Auto Credit has grown their floorplan by over 150% with Kinetic.

“I view our relationship as a partnership, so I treat it as a collaboration of Kinetic Advantage providing me with the funding to grow my business while I make sure I consistently make all of my payments on time.”

Average Vehicle Turn Time

< 67 days

Average Vehicles in Inventory

70

Pros and Cons of Floor Plan Loans

Similar to any financing strategy, floor planning loans has their pros and cons. The cyclical nature of the automobile industry is well-served by the floor planning strategy, as it provides the necessary resources to buy more inventory when the sales season is approaching.

The downside to this would be financing costs, which might surpass the dealership’s capacity to repay if not managed responsibly.

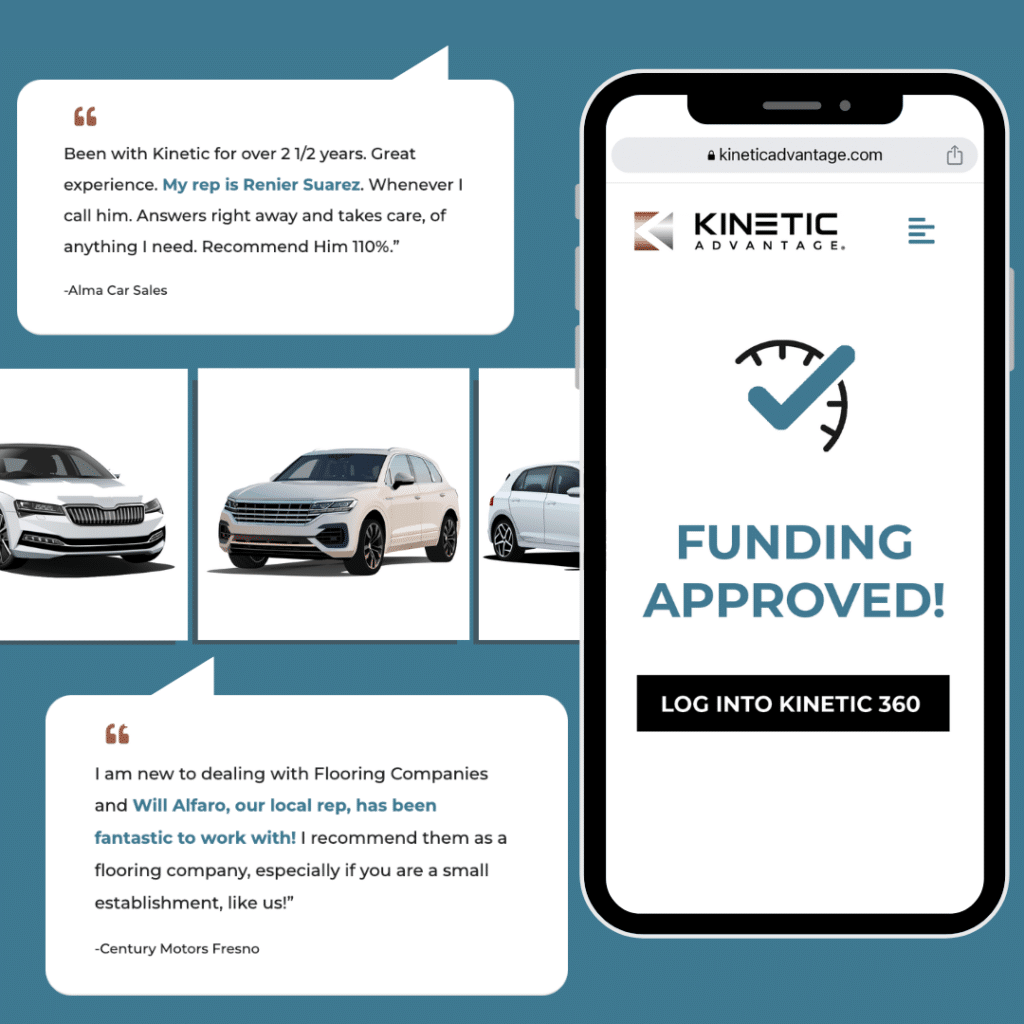

Fortunately, Kinetic Advantage provides tools and hands-on attention from our field reps that help mitigate these potential issues.

Learn more about the Kinetic Reps and how they set you up for success with your floor plan loans.

Effectiveness of Floor Plan Financing and the Future

Deciphering the End Game: Effectiveness of Floor Plan Financing

Floor plan financing has emerged as a game-changer in the arena of independent auto dealerships. This financing method brings a multitude of benefits to the table. Its ability to help dealers increase their inventory is the most obvious benefit.

By leveraging their floor plan credit lines to finance the inventory, auto dealerships can have a wider selection of cars, trucks, and SUVs on their lots, appealing to a broader customer base.

What sets floor plan financing apart from other traditional methods is its alignment with the essence of auto dealing. The sell-to-pay structure resonates perfectly with dealership operations and promotes success.

The steady, consistent flow of capital allows a dealership to keep up with market demand, meaning a well-stocked lot translates into increased sales.

Embracing the Future with Floor Plan Financing

It’s no secret that the auto industry is fiercely competitive. The increasing pressure calls for a change in strategies to stay ahead of the curve – and floor plan financing is the adaptable tool independent auto dealerships need. The advantage provided by immediate access to funds through floor plan lines of credit can keep dealerships nimble and ready to capitalize on market opportunities.

The potential of floor plan financing extends far beyond just financing inventories. It paves the way for businesses to invest in growth strategies, diversify their offerings, and make strategic seasonal adjustments. With the right vision, floor plan financing can be the driving force behind a dealership’s future success.

For the latest on the current economic headwinds facing the independent dealer, read more here.

Whether you’re an independent dealer dealing with peak season surges or aiming for business expansion, floor plan loans, or floor plan lines of credit, can be the catalyst for growth.

Independent auto dealers should not shy away from exploring this exciting financing avenue as a significant strategy for their future business growth.

What Drives You?

What Drives You?

The dealership floorplanning newsletter that takes a look into recent floorplan news & trends, as well as updates from inside the walls at Kinetic Advantage.

(We promise not to spam you or inundate your inbox with emails. Our newsletter goes out roughly twice per month to include important news and information around dealer floorplanning.)