Written by:

Joe Keadle

SVP of Sales & Marketing

Kinetic Advantage

View Joe’s Bio

For independent used car dealerships, financing inventory can be a major challenge. Cash flow and sales projections must strike a delicate balance, and the cost of purchasing inventory outright can be prohibitive.

That’s where floorplan financing companies come in. Floor plan financing is a way for dealerships to finance their inventory, acquiring vehicles on credit and paying it off as they make sales.

In this article, I will explore what floor plan financing is, how it works, and why it can be a beneficial option for independent used car dealerships.

Auto Dealer Floorplan Financing Explained

Auto dealer floor plan financing is a specialized form of vehicle inventory financing that enables independent car dealerships to access the capital they need to purchase and stock their lots.

With floor planning, dealerships can acquire a wide selection of vehicles, making them readily available for customers to test drive and purchase. The lender retains the titles of the vehicles until they are sold to end-users.

Note: When researching car dealer floor plan companies, make sure to ask about the title management process. You should be able to view your titles in real time, receive overnight title returns and manage the whole process with ease. Here is how we do it.

When cars are sold, the dealership pays back the original balance plus interest. This allows dealerships to keep a revolving supply of inventory without having to make large upfront purchases or drain their entire cash flow.

How Does Car Dealership Floorplan Financing Work?

Floor plan financing works similarly to a revolving line of credit.

It is a type of short-term financing designed to help dealerships cover the cost of their inventory while also allowing them to adjust their stock without incurring a major financial burden. When a dealership wants to purchase a vehicle, they send a request to their finance company. When approved, the finance company will release funds for the vehicle purchase.

The finance company then holds the title to the vehicle. As the dealership sells the car, they pay back the original balance plus interest and then take out additional capital to buy new inventory.

What Are the Benefits of Auto Dealer Floor Planning?

Floor plan financing offers several benefits to independent dealerships.

By using a line of credit, dealers can maintain a healthy cash flow while also stocking a diverse inventory. This helps dealers attract a wider range of customers, as well as respond quickly to changing market trends.

Grow Your Business With Kinetic Advantage

Grow Your Business With Kinetic Advantage

210 Auto Credit has grown their floorplan by over 150% with Kinetic.

“I view our relationship as a partnership, so I treat it as a collaboration of Kinetic Advantage providing me with the funding to grow my business while I make sure I consistently make all of my payments on time.”

Average Vehicle Turn Time

< 67 days

Average Vehicles in Inventory

70

Expanding on the Key Benefits of Car Dealership Floor Plan Financing

Floor plan financing offers several advantages for both dealerships and customers. I’ll explore some of the key benefits:

-

Increased Inventory

Floor plan financing allows dealerships to maintain a larger inventory, ensuring a wide selection of vehicles for customers to choose from. This increases the likelihood of making a sale and satisfying customer preferences.

-

Streamlined Inventory Acquisition

By accessing funds from a lender, dealerships can quickly and efficiently acquire new vehicles, keeping their inventory up-to-date and attractive to potential buyers.

-

Enhanced Customer Experience

With a well-stocked inventory, dealerships can offer customers the opportunity to test drive and purchase vehicles immediately. This immediate availability improves customer satisfaction and can lead to higher sales.

-

Improved Cash Flow

Floor plan financing frees up cash flow for dealerships, as they can allocate their funds to other operational expenses. This flexibility allows dealerships to invest in marketing, staff training, and other initiatives that drive business growth.

-

Reduced Administrative Costs

By utilizing floor plan financing, dealerships can streamline their inventory acquisition process and reduce administrative tasks associated with purchasing vehicles outright.

What Are the Risks of Car Dealer Floor Planning?

While floor plan financing can be a helpful option for independent car dealerships, there are some risks involved.

Dealerships who struggle to sell their inventory quickly may be at risk of accruing higher interest rates or other charges.

Some non-Kinetic dealers have also expressed frustration with hidden or excessive admin and audit fees.

Tips for Effectively Managing Auto Dealer Floor Plan Financing

While floor plan financing offers numerous advantages, there are important factors that dealerships should consider before implementing this financing option.

Let’s delve into these factors:

1. Responsible Inventory Management

Dealerships must exercise responsible inventory management to ensure they do not overextend their borrowing capacity. It is crucial to purchase inventory in proportion to sales figures and avoid buying more than can be sold. Overextending inventory can lead to difficulties in making loan payments and raise concerns with lenders about the stability of the business.

2. Effective Communication with Your Floor Plan Lender

Maintaining open and transparent communication with your lender is essential. Dealerships should inform lenders of any changes that may affect inventory or business operations. This includes temporary relocations of certain vehicles or any potential challenges in making timely payments. Your floor planning partner may also offer a deferment program for when you need to push a payment date back.

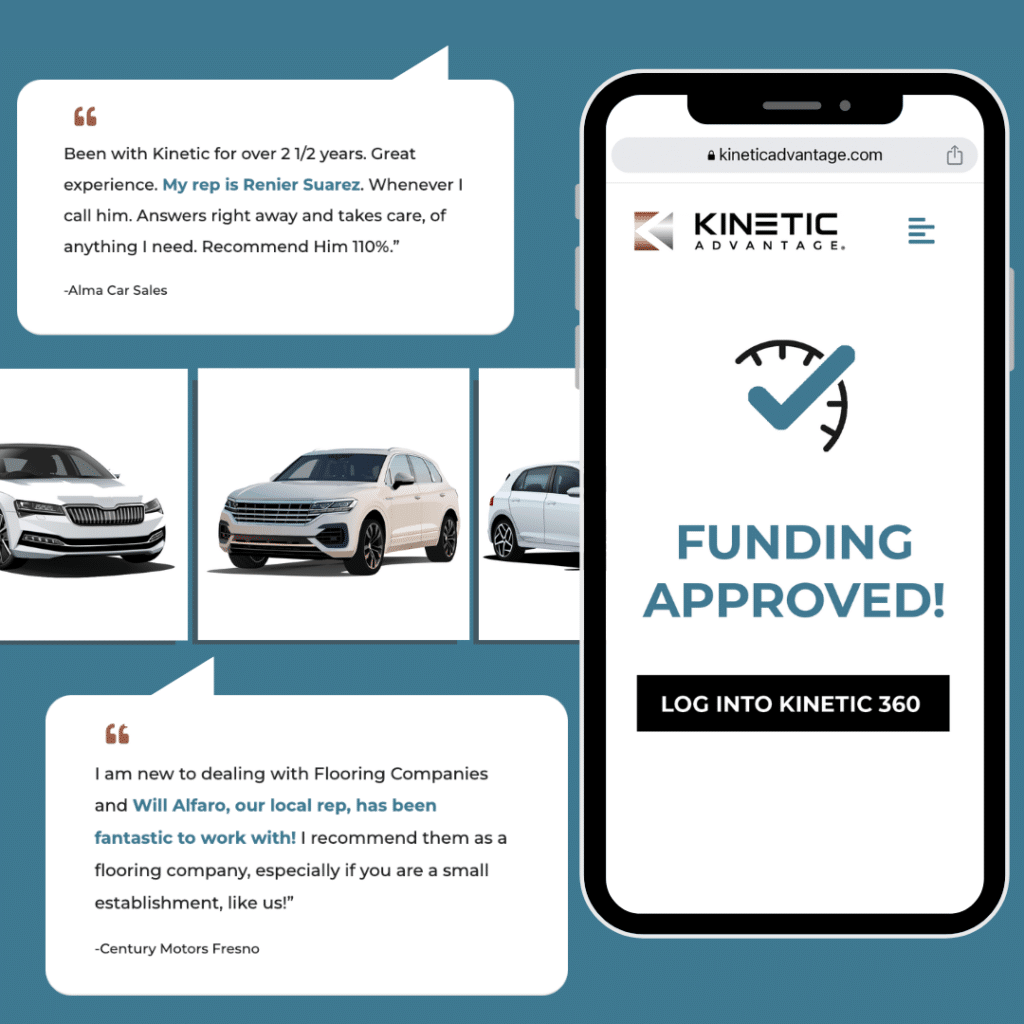

The biggest takeaway from what I said above is the term ‘floor planning partner.’ Whereas some floor plan providers may treat the relationship with dealers very transactionally, we really believe in advocating for our dealer partners.

This means that we take the time to get to know you, your business, and your goals. We aren’t here just to provide funding. We’re here to help you grow and succeed.

3. Managing Cash Flow

While floor plan financing can improve cash flow by freeing up funds for other expenses, dealerships must exercise prudence in managing their finances. It is crucial to avoid situations where multiple bills mature simultaneously, potentially leaving the dealership unable to meet its financial obligations. Effective cash flow management ensures financial stability and prevents liquidity issues.

4. Regular Collateral Audits

Dealerships should ensure that lenders can easily verify their inventory during regular collateral audits.

When lenders encounter difficulties in verifying inventory, it raises concerns about the dealership’s ability to fulfill its loan obligations. Dealerships should prioritize maintaining an accurate and accessible inventory record.

This short video tutorial will show you how quick and easy it is to complete a dealer self-audit (DSA) with Kinetic Advantage using the Real-Time Intelligent Auditing 12th Tech S.M.A.R.T. System.

5. Timely Inventory Turnover

In the auto retail business, the ideal timeframe for vehicle turnover is within 45 days. As time progresses, profit margins decrease, making it crucial to sell vehicles promptly. If a particular vehicle remains unsold for an extended period, dealerships may need to consider auctioning or selling it at a reduced price to avoid inventory stagnation and maintain a healthy turnover rate.

Finding the Right Floor Plan Lender

When seeking floor plan financing, dealerships should choose a lender with experience in working with auto dealerships. In other words, there are some obvious, and maybe less obvious, benefits of floorplan financing compared to traditional banks.

It is crucial to research the lender’s track record in floor plan lending and understand their operational processes for audits, reporting, and payment procedures.

Building a strong relationship with the lender based on trust and transparency is essential for long-term success.

Get Floorplanning News & Insights Straight to Your Inbox

The dealership floorplanning newsletter that takes a look into recent floorplan news & trends, as well as updates from inside the walls at Kinetic Advantage.

What is Floor Planning – A Recap

Floor plan financing is a powerful tool that allows car dealerships to unlock the potential of inventory acquisition.

By leveraging lenders’ funds, dealerships can maintain a diverse and readily available inventory, enhancing the customer experience and driving sales.

However, responsible inventory management, effective communication with lenders, and prudent financial management are crucial for success.

By considering these factors and partnering with the right lender, dealerships can harness the benefits of floor plan financing and thrive in a competitive market.

To learn more about us, meet our team or learn more about our approach to floorplanning.

What Drives You?

What Drives You?

The dealership floorplanning newsletter that takes a look into recent floorplan news & trends, as well as updates from inside the walls at Kinetic Advantage.

(We promise not to spam you or inundate your inbox with emails. Our newsletter goes out roughly twice per month to include important news and information around dealer floorplanning.)