Independent Dealership Floorplanning

Independent Dealership Floorplanning

FOR INDEPENDENT DEALERS LIKE YOU

FOR INDEPENDENT DEALERS LIKE YOU

With a Kinetic Floorplan, You Get:

APPLY NOW

What is Floorplanning or Floorplan Financing?

Floorplan financing is a line of credit, solely for the purchasing of vehicle inventory, which provides the dealer with an extended amount of time to pay for the purchase of inventory.

In doing so, this line of credit relieves the dealer from using their own cash, allowing them to use that money on other needs of the dealership, rather than the cash being tied up in inventory for a potentially lengthy period of time.

Summary: Floorplanning is a credit arrangement that allows car dealers to purchase inventory without using their own cash, giving them more financial flexibility for other business needs.

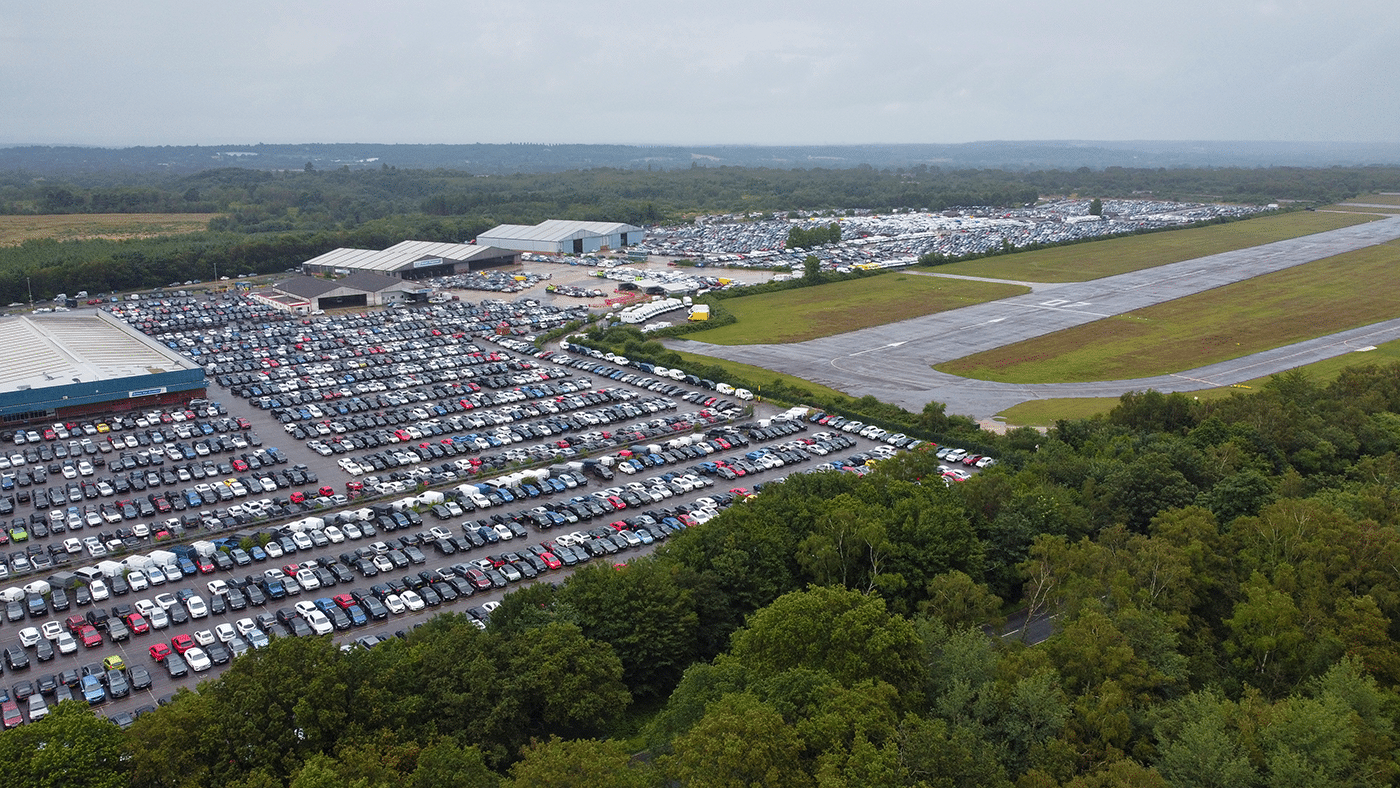

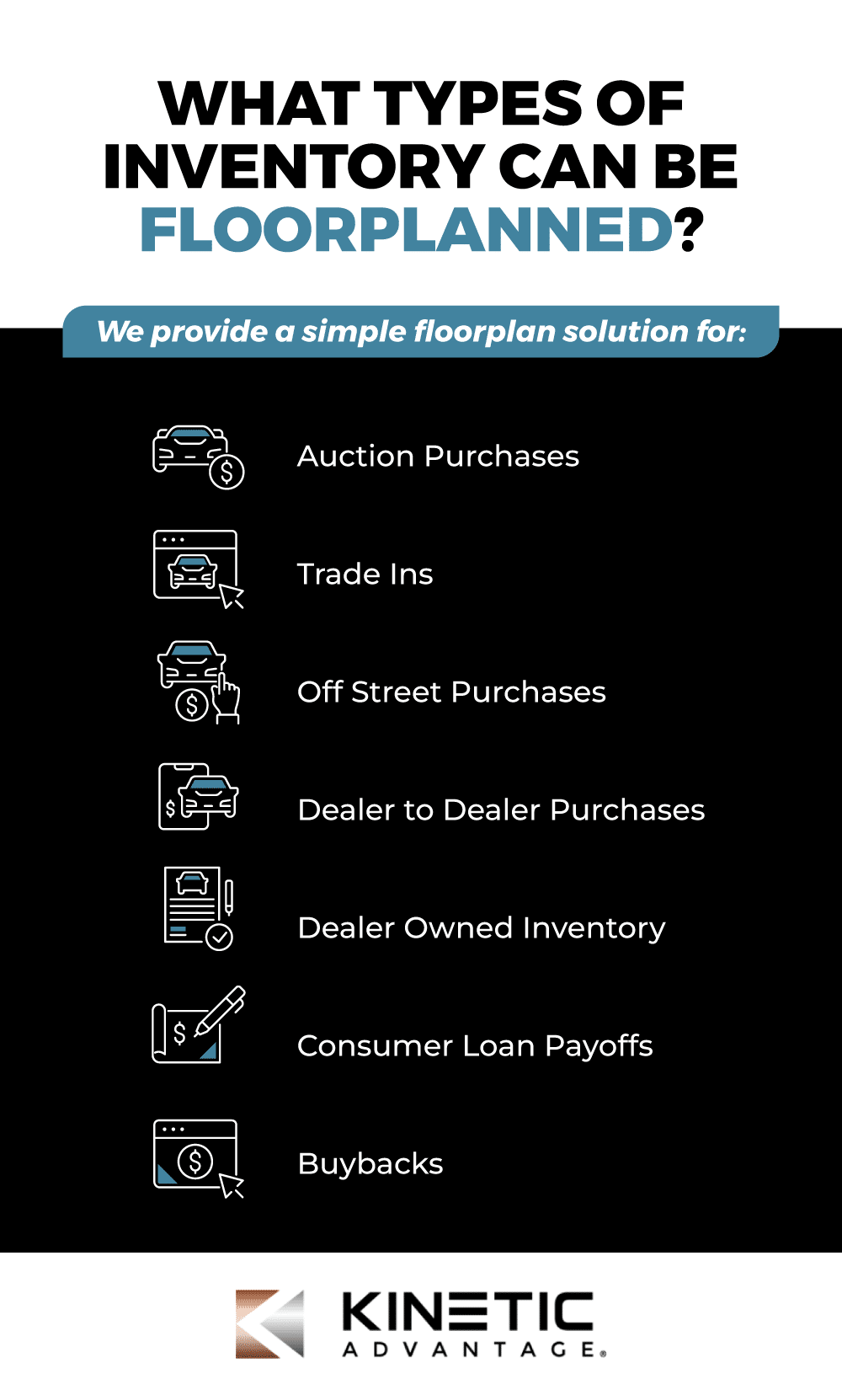

What Types of Inventory Can Be Floorplanned?

We provide a simple floorplan solution for:

→ Auction Purchases

→ Trade-Ins

→ Off-Street Purchases

KINETIC’S FLOORPLANNING PROGRAMS

Our Floorplan Financing Solutions offer flexible term plans with a simple structure and advances up to 100% of purchase price. Learn more about our floorplanning programs below, or click the button to learn more about our overall floorplanning solution.

Dealership Floorplanning Company – The Ultimate Guide

So, you’re interested in a floorplan? What’s next?

In today’s marketplace, your dealership’s profit centers are being squeezed from multiple angles. Vehicle values are up, retail loan advances guidelines are trailing behind the market values, and customers are savvier about market values than ever before. Many dealerships must turn to a floorplan provider in order to have enough liquidity to acquire the right inventory and stock their lots at the right level.

Floorplan providers should be viewed as a tool for success and must be managed and understood for their impact to benefit your dealership’s bottom line.

If you choose to utilize a floorplan, it quickly becomes a key tool in your inventory management and acquisition strategies. It is vitally important to consistently evaluate your floorplan options to ensure you are maximizing their value to drive your dealership forward. To fully grasp your dealership’s floorplan costs, you must begin by analyzing both indirect and direct costs, including the level of service, cashflow flexibility, inventory acquisition options, the interest and fee structure along with re-occurring ancillary fees.

You may be thinking that this is starting to sound like work, but, next to your employee costs, floorplan expense is typically the second highest expense item for an independent dealership.

A thorough and careful review of the indirect and direct costs will yield significant understanding of the relationship your floorplan provider has on your dealership’s bottom-line.

But it is important to understand that evaluating a floorplan provider on a straight cost basis alone is unwise. The ability to source the inventory that best fits your dealership’s needs at the lowest cost and with the least difficulty is not just a straightforward effective interest rate question, it is also a question of service.

Apply for Floor Plan Financing Today

At Kinetic Advantage, we understand that small independent car dealerships have unique needs when it comes to inventory financing. That’s why we offer tailored solutions specifically designed for your business.

Our car dealership inventory financing services are designed to help you acquire the inventory you need to keep your lot stocked with the vehicles your customers want. We know that managing inventory can be a challenge, which is why we work with you to provide flexible financing options that fit your specific needs.

Whether you need short-term financing to acquire a specific vehicle or a long-term solution to keep your lot stocked, we have the expertise to help.

Trust us to help you take your small independent car dealership to the next level with our expert car dealership inventory financing services.

Apply Now