STEERING SUCCESS

STEERING SUCCESS

Mastering Dealership Profitability through Strategic Operations

Mastering Dealership Profitability through Strategic Operations

Presented by:

Joe Keadle

SVP of Sales & Marketing

Three Areas of Focus as we Exit the Downturn

It’s a Fiercely Competitive Market

(not in your control)

Internal Measures You Can Take to Maximize Profitability

(in your control)

Bringing it All Together

(How do your dealership numbers stack up?)

Real Gross Domestic Product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2024, according to the “third” estimate. In the first quarter, real GDP increased 1.6 percent (revised). The second-quarter increase in real GDP was the same as previously estimated in the “second” estimate released in August.

The increase in the second quarter primarily reflected increases in consumer spending, inventory investment, and business investment. Imports, which are a subtraction in the calculation of GDP, increased.

Wholesale Used-Vehicle Prices Declined in September

Wholesale values reversed course and turned negative over the month of September after rising in July and August.

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in September compared to August. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.0, a decline of 5.3% from a year ago.

The seasonal adjustment to the index amplified the change for the month, as non-seasonally adjusted values fell slightly. The non-adjusted price in September decreased by 0.1% compared to August, moving the unadjusted average price down 4.9% year over year.

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 0.2% from August in the first 15 days of September. The mid-month Manheim Used Vehicle Value Index decreased to 203.6, down 5.0% from the full month of September 2023.

The seasonal adjustment softened the results. The non-adjusted price change in the first half of September rose 0.2% compared to August, while the unadjusted price was down 4.6% year over year. The average change for the month of September is an increase of two-tenths of a point for seasonally adjusted values, so the current measure is below trend for the early read of the month.

Impact on Prices and Payments

Difference between the inflation rate and growth of wages in the U.S. from August 2020 to August 2024

In August 2024, inflation amounted to 2.5 percent, while wages grew by 4.6 percent. The inflation rate has not exceeded the rate of wage growth since January 2023.

Used loan amounts decrease and despite rate increases, payments decrease YOY

Source: Experian

*most recent data as of September 2024

Used Supply

The rate of inflation exceeded the growth of wages for the first time in recent years in April 2021. In March 2024, inflation amounted to 3.5%, while wages grew by 4.7%.

Three Areas of Focus

It’s a Fiercely Competitive Market

(not in your control)

Internal Measures You Can Take to Maximize Profitability

(in your control)

Bringing it All Together

(How do your dealership numbers stack up?)

How Do I Know if My Dealership is Profitable?

Lost Revenue

Holding Costs

Break Even

What are the metrics you need to use to determine if your business is profitable?

Lost Revenue

What is it?

How is it calculated?

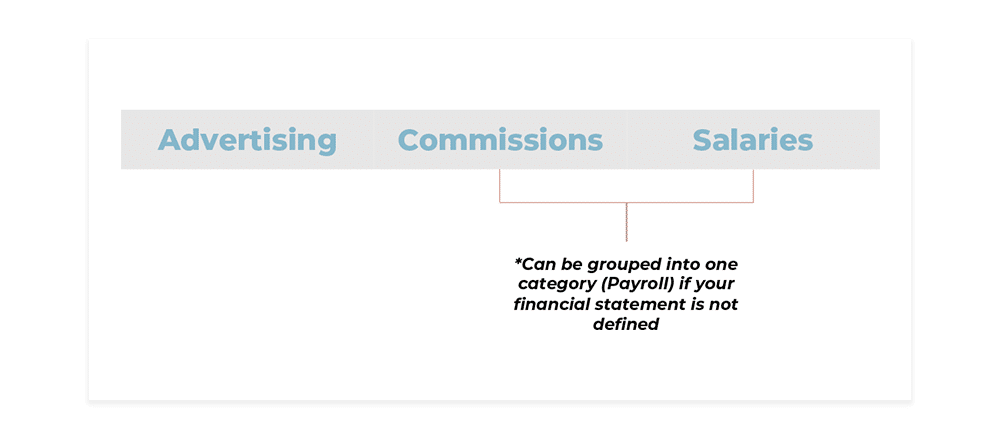

Average Daily Holding Costs

Selling Expenses

Expenses usually not absorbed by the buyer

Average Daily Holding Costs

What is it?

How is it calculated?

Breakeven Measurement

How long can you hold a unit in stock?

The number of days the unit can remain on lot to breakeven.

See…Math is fun!

▪ LOST REVENUE

Aged Inventory × $ Potential Earnings = Lost Revenue

10 units × $5,250 = $52,500 lost revenue

▪ HOLDING COSTS

Monthly Holding Costs per Unit / Number of Selling Days within the Month = Daily Holding Costs

$808.82 per unit / 22 days = $36.76 per day

Using a 60-day avg. turn-time, subtract from the total number of days in inventory to get a true loss

180 days in stock – 60-day avg turn = 120 days

120 days × $36.76 holding cost per day = $4,411.20/unit

$4,411.20 × 10 units = $44,112 in holding costs

▪ TOTAL LOSS FOR AGED INVENTORY

Potential Earnings + Total Holding Costs = Total Loss

$52,500 potential earnings + $44,112 holding costs = $96,612 in total loss

Three Areas of Focus

It’s a Fiercely Competitive Market

(not in your control)

Internal Measures You Can Take to Maximize Profitability

(in your control)

Bringing it All Together

(How do your dealership numbers stack up?)

Key Management Tools

Strongest Considerations

- How much cash on hand?

- Where should I be looking for cash?

- What are my holding costs and their impact on cash?

Questions?

Stop by Kinetic Advantage Booth to get your copy of the presentation and Dealership Profitability workbook.